mississippi state income tax form

24 Mississippi income tax withheld complete Form 80-107 25 Estimated tax payments extension payments andor amount paid on original return. Mississippi Income Tax Forms.

Mississippi Tax Rate H R Block

Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return.

. Welcome to The Mississippi Department of Revenue. Download the Employer Change Request form. 0621 Mississippi Individual Fiduciary Income Tax Voucher Instructions Who Must Make Estimated Tax Payments Every individual taxpayer who does not have at least eighty percent 80 of hisher annual tax liability prepaid through withholding must make estimated tax.

And you are filing a Form. Single File this form with your employer. Printable Income Tax Forms.

Complete Edit or Print Tax Forms Instantly. The current tax year is 2021 with tax returns due in April 2022. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face.

Access IRS Tax Forms. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets. Mississippi has a state income tax that ranges between 3 and 5 which is administered by the Mississippi Department of Revenue.

Renew Your Driver License. 18 Credit for tax paid to another state from Form 80-160 line 14. 3 LEGISLATIVE CHANGES REMINDERS 3 3 FILING REQUIREMENTS.

Payment Voucher and Estimated Tax Voucher 80106218pdf Form 80-106-21-8-1-000 Rev. All other income tax returns. Ad Free 2021 Federal Tax Return.

Line item instructions are generally the same for both the Resident and the Non-Resident returns. Box 22781 Jackson MS 39225-2781. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Mississippi State Tax Forms 2011-2022. We last updated Mississippi Form 80-205 in January 2022 from the Mississippi Department of Revenue. If you live in MISSISSIPPI.

27-7-17 to provide that for the state income tax deduction authorized for depreciation in the. This form is for income earned in tax year 2021 with tax returns due in April 2022. Mississippi Department of Employment Security Tax Department PO.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Purchase Hunting Fishing License. E-FIle Directly to Mississippi for only 1499.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Mississippi government. Mississippi state income tax Form 80-105 must be postmarked by April 18 2022 in order to avoid penalties and late fees. Department of the Treasury Internal Revenue Service Austin TX.

Attach other state return 19 Other credits from Form 80-401 line 1 21 Consumer use tax see instructions. NAIC Company Code E-Mail Enter your E-Mail Address here. The credit may not exceed the amount of income tax due the State of Mississippi indicated on line 17.

House Bill 1356 2021 Legislative Session Miss. To provide the order in which a rebate or credit shall be certified. If you are receiving a refund.

File Now with TurboTax. Details on how to only prepare and print a Mississippi 2021 Tax Return. Itemized Deductions Schedule 80108218pdf Reset Form Form 80-108-21-8-1-000 Rev.

19 rows 37 PDFS. The Department of Revenue is responsible for titling. You must file online or through the mail yearly by April 17.

The income tax return for the tax year for which the credit is certified. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. And you ARE ENCLOSING A PAYMENT then use this address.

And you ARE NOT ENCLOSING A PAYMENT then use this address. Form 80-100-21-1-1-000 Rev821 RESIDENT NON-RESIDENT AND PART-YEAR RESIDENT 2021 INCOME TAX INSTRUCTIONS INDIVIDUAL INCOME TAX BUREAU PO BOX 1033 JACKSON MS 39215-1033 WWWDORMSGOV fTABLE OF CONTENTS WHATS NEW. E-File Free Directly to the IRS.

Individual Income Tax Instructions. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Form 80-105 is the general individual income tax form for Mississippi residents.

A downloadable PDF list of all available Individual Income Tax Forms. Form 80-100 - Individual Income Tax Instructions. Take a credit against your Mississippi income tax due in the same year for the total income tax due to the other state subject to certain limitations.

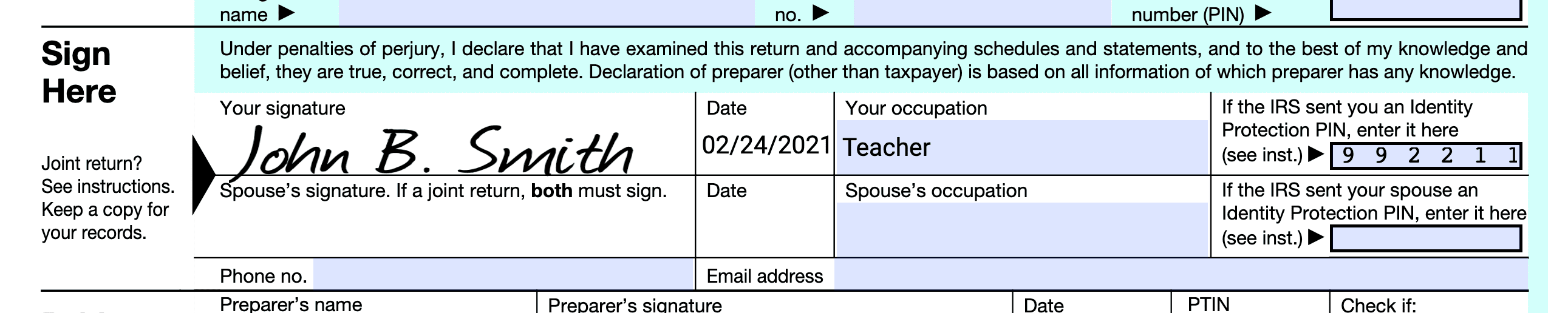

The below instructions serve as a general guide for filing your 2013 Mississippi Resident Individual Income Tax Return Form 80-105 or your 2013 Mississippi Non-Resident or Part-Year Resident Individual Income Tax Return Form 80205. Change Please make changes on the address label Filing Status AMENDED return Enter your Federal ID Number here. 819 MISSISSIPPI EMPLOYEES WITHHOLDING EXEMPTION CERTIFICATE Employees Name SSN Employees Residence Address Marital Status EMPLOYEE.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. We will update this page with a new version of the form for 2023 as soon as it is made available by the Mississippi. Line 13 Enter the amount of income tax due on Form 80-105 page 1 line 17 or Form.

More about the Mississippi Form 80-108. We last updated Mississippi Form 80-108 in January 2022 from the Mississippi Department of Revenue. The personal exemptions allowed.

The 2022 state personal income tax brackets are updated from the Mississippi and Tax Foundation data. E-File Directly to the IRS State. Mississippi has a state income tax that ranges between 3000 and 5000.

The form features space to include your income marital status as well as space to report any children or dependents you may have. You may file your Form 80-105 with paper. Taxpayer Access Point TAP Online access to your tax account is available through TAP.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Use a mississippi state tax forms printable 2011 template to make your document workflow more streamlined. The Mississippi income tax rate for tax year 2021 is progressive from a low of 0.

MS Form 80-105 2018. Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. Otherwise you must withhold Mississippi income tax from the full amount of your wages.

0621 Print Form Mississippi Adjustments And Contributions 2021 801082181000 Taxpayer Name Page 1 SSN PART I. Department of Revenue - State Tax Forms. TaxFormFinder provides printable PDF copies of 37 current Mississippi income tax forms.

Mississippi tax forms are sourced from the Mississippi income tax forms page and are updated on. This website provides information about the various taxes administered access to online filing and forms. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Mississippi Individual Resident Income Tax Return Long Mississippi form 80-105 is designed for state residents to report their annual income. Once you have completed the form you may either e-mail it as an attachment to candsmdesmsgov or fax it to 601-321-6173 or print it out and mail it to. SCHEDULE A - ITEMIZED DEDUCTIONS ATTACH FEDERAL FORM 1040 SCHEDULE A In the event you filed using the standard deduction on your federal return and.

State W 4 Form Detailed Withholding Forms By State Chart

State Income Tax Rates Highest Lowest 2021 Changes

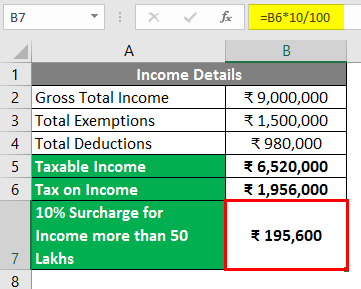

How To Calculate Income Tax In Excel

State Corporate Income Tax Rates And Brackets Tax Foundation

Individual Income Tax Forms Dor

Where S My Refund Mississippi H R Block

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Individual Income Tax Forms Dor

Free 7 Sample Tax Forms In Pdf

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

State Corporate Income Tax Rates And Brackets Tax Foundation

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

How To Calculate Income Tax In Excel

State W 4 Form Detailed Withholding Forms By State Chart